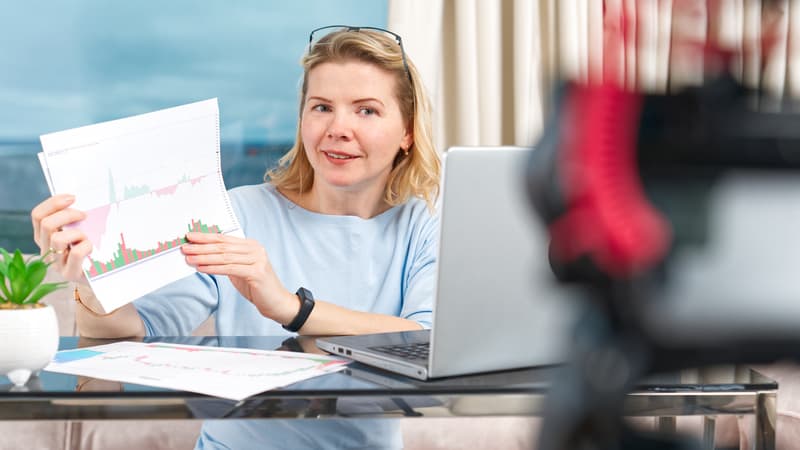

‘Finfluencers’ Offer Free Financial Advice

But can you trust them?

Are you wondering how to rebuild a car engine, apply eyeliner or build a castle in Minecraft? Millions of Americans get their answers from “influencers” on social media. And now a growing crowd of “finfluencers” are vying to become your investing gurus.

Search “investing” or a related term on Instagram, TikTok or any other major social media platform, and you’ll get thousands of posts from a dizzying array of creators. You’ll see videos of investors flaunting wads of cash, driving Lamborghinis or flashing screenshots purportedly showing big profits from options trading, cryptocurrencies or “passive income” investing strategies. You’ll also see investing basics demonstrated with card tricks, comedy skits or dance celebrations.

The most-popular investing social media mavens have amassed millions of followers and are earning millions of dollars from advertisements, sponsorships, book sales, and membership and consulting fees. Many are succeeding for good reason: They provide sound advice in entertaining ways.

For Denise Berkhalter, a 51-year-old single mother of two, the fun, high-energy videos by former Wall Street trader Vivian Tu provided encouragement for her to maximize her employer’s retirement plan match and maintain both a regular and a Roth IRA.

“She’s hilarious,” says Berkhalter. “She’s relatable. She takes the time to break things down into understandable bite sizes. And she’s willing to talk about her own mistakes, which is helpful because you realize you don’t have to be perfect.”

But some influencers promote strategies that are inappropriate for many, if not most, investors. Worse: Social media platforms are also rife with scamsters.

Federal regulations require influencers to clearly label any posts for which they are being paid and bar misleading statements or frauds, such as “pump-and-dump” schemes in which influencers secretly sell shares in stocks they are hyping to their followers. And the government has pursued some high-profile influencers.

The Securities and Exchange Commission has extracted millions of dollars collectively from celebrities including Kim Kardashian and Lindsay Lohan to settle charges that they improperly failed to disclose they were being paid to promote cryptocurrencies on their social media feeds on Instagram and Twitter (now known as X).

The SEC has also charged several popular finfluencers with running pump-and-dump schemes. And, undoubtedly, a lot escape scrutiny. So many people are now making investment-related content “it is literally not possible” for budget-constrained federal regulators to monitor and police all of it on all social media platforms, says Ankush Khardori, a former federal prosecutor who specialized in financial crimes.

Even if you don’t take investing advice from social media stars, you should be aware of the landscape because the odds are that your friends and relatives do. A study by Finra, the self-regulatory organization for brokers, found that 60% of investors younger than 35 get investing information from social media. What’s more, social media investing frenzies can significantly impact the values of stocks in your portfolio. Recall the mayhem in GameStop and other “meme” stocks engineered by Reddit users in 2021.

Kim Clark is senior associate editor at Kiplinger Personal Finance magazine. For more on this and similar money topics, visit Kiplinger.com.

©2024 The Kiplinger Washington Editors, Inc. Distributed by Tribune Content Agency, LLC.

Tongue-in-cheek: A self-professed old dude tries out social media